Earn a return on your idle funds with Verto Reserve

Earn interest in G10 and African countries as a non-resident.

Earn interest and manage cross-border payments from one platform

On deposits in non-resident countries including emerging market and G10 currencies. Verto is offering the Reserve product with financial institutions partners that have the necessary licenses in Kenya and Nigeria to provide deposit-taking services.

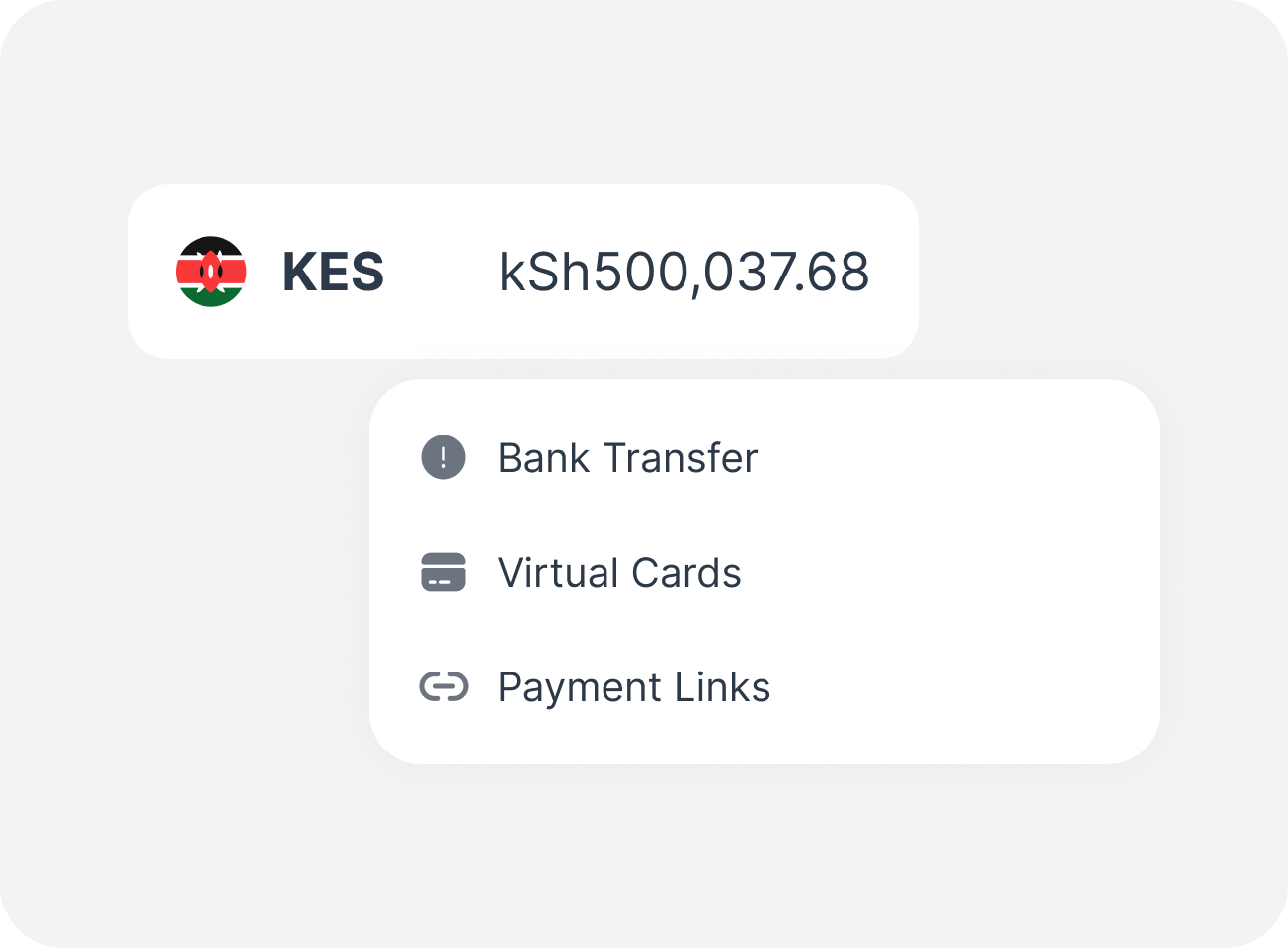

One platform that integrates with your day-to-day payments.

Access a global selection of interest-bearing accounts and earn competitive interest rates.

Start earning interest today!

Access Verto Reserve

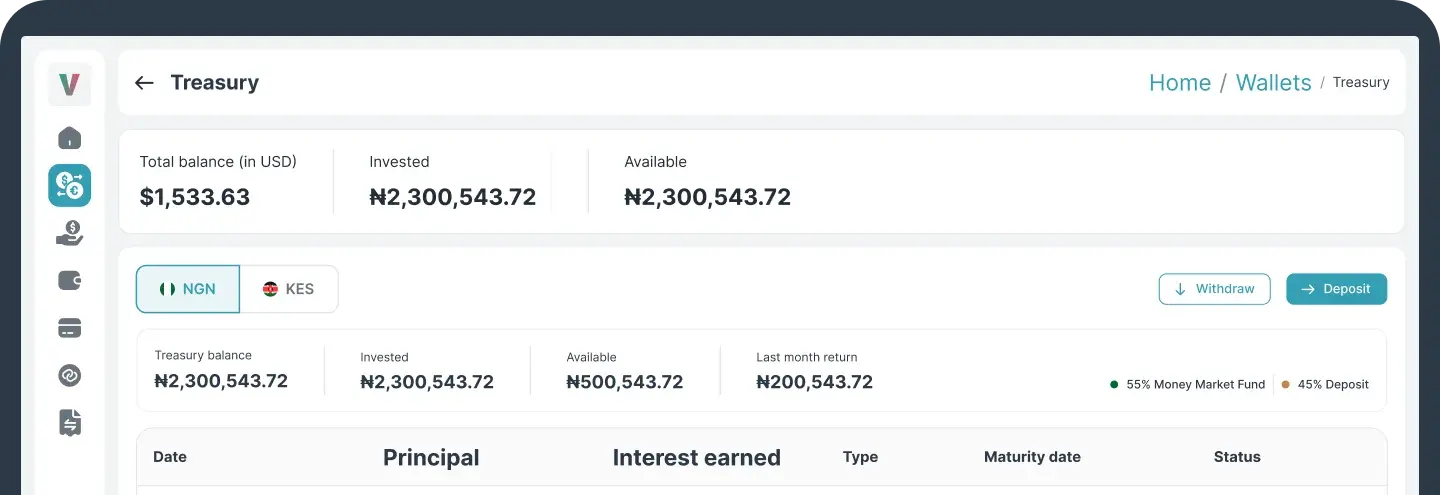

Log in to the Verto platform and navigate to ‘Wallets.’

Choose currency

Select your preferred currency and click ‘Deposit.’

Create a new deposit

Choose your source of funds, amount, investment vehicle and duration.

Wait for approval

Deposit status appears as pending and then ongoing once activated.

Watch your funds grow!

See your total funds in the available balance.

Frequently Asked Questions

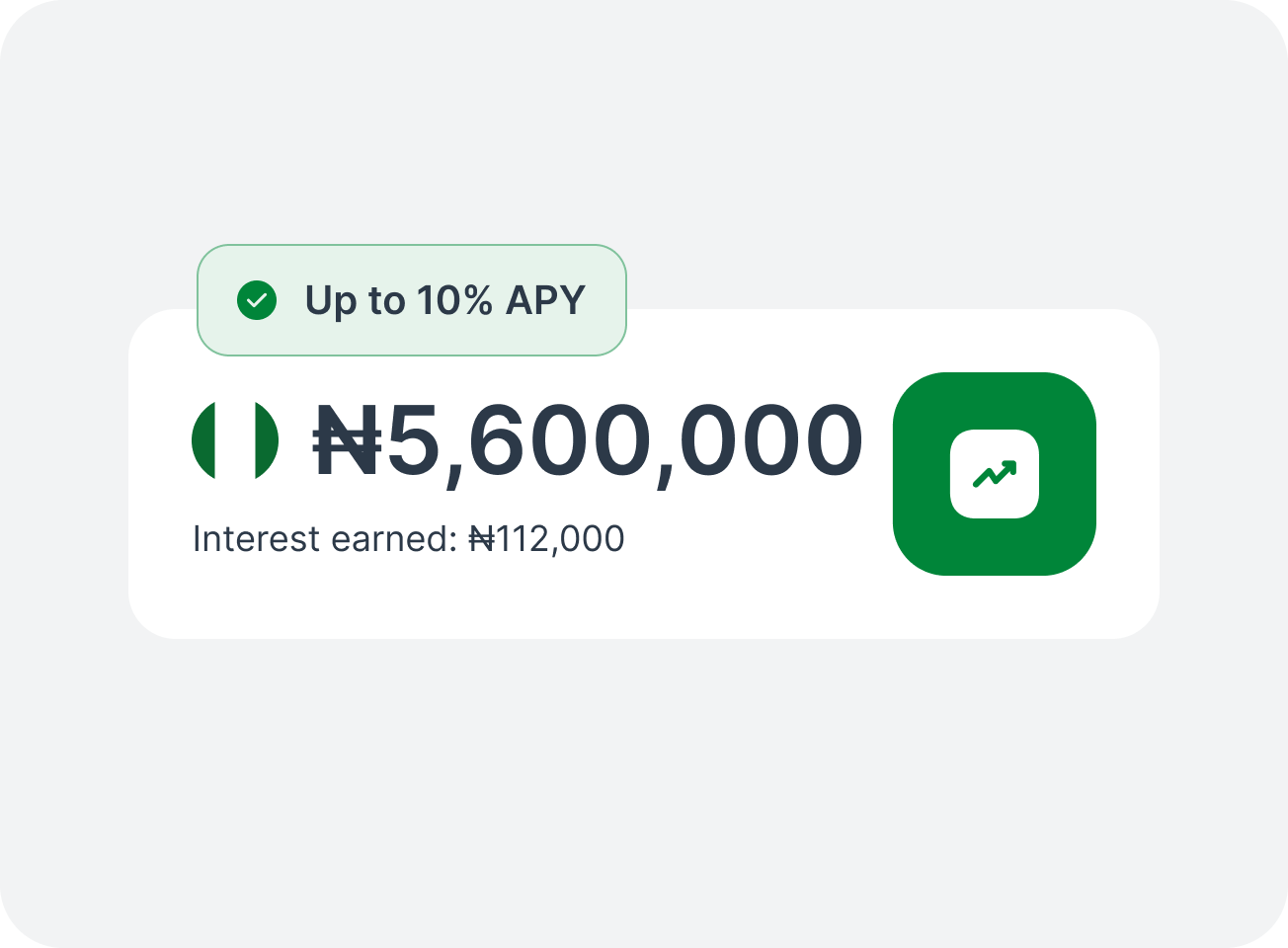

You can earn up to 10% interest on your funds held in eligible currencies, depending on your currency and product chosen.

Fixed deposits

Earn yield without moving funds, multi-currency support, and simplified treasury management.

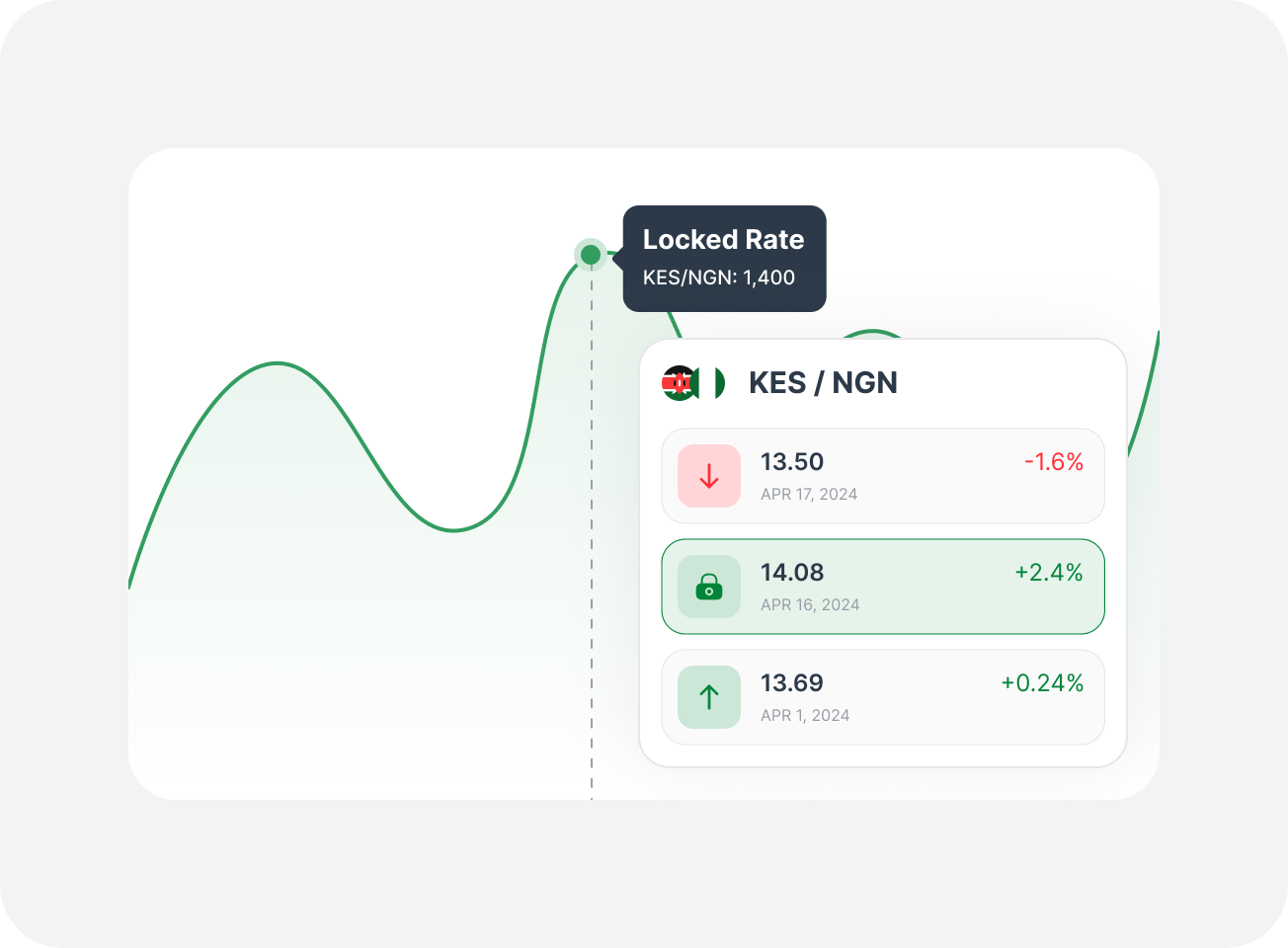

Currently, Verto Reserve supports interest-earning accounts in Nigerian Naira (NGN), and Kenyan Shilling (KES). USD is also on offer but not for companies headquartered in the US or UK. Verto plans to expand this offering in the future.

No, that's one of the key benefits of Verto Reserve! You do not need to have a local entity in these countries to benefit from local currency interest rates. This eliminates a significant barrier for global businesses.

Yes, the minimums are 500 million Naira, $100k, and 13 million Kenyan Shilling.

When a user navigates to their Reserve section, they will see a table of all deposits and maturity dates.

Once a maturity payout has been completed, and the funds are credited to the user’s Reserve wallet, they shall receive a confirmation notification.

Verto Reserve is designed for businesses operating globally, that hold significant balances in various currencies. The only exception to this is companies headquartered in the UK, US, South Africa or the UAE.

Discover the Verto difference

Pricing built for businesses of all sizes

Designed for your budget

Access a complete payments platform with simple, pay-as-you-go pricing. No setup fees, monthly fees, or hidden fees.

Free

$0/month

Lite

$25/month

Popular Emerging

$100/month

Enterprise

Custom

Embark on a journey through the financial landscapes of Nigeria, South Africa, and Kenya in our latest e-book, where we unravel the dynamic shifts shaping the payment industry in 2024. From the rise of innovative fintech products to the emergence of new regulatory frameworks, we explore the implications for the financial industries of these countries.